Local councils in the UK are facing an existential crisis, with many grappling with a combination of moral, financial, and operational challenges that threaten their ability to serve their communities effectively. From massive budget shortfalls to failing public services, councils are struggling to meet the needs of the people who rely on them. This article explores why some UK councils are morally and financially bankrupt, examining both the financial mismanagement and the ethical failings that contribute to the crisis.

The Financial Crisis: A Ticking Time Bomb

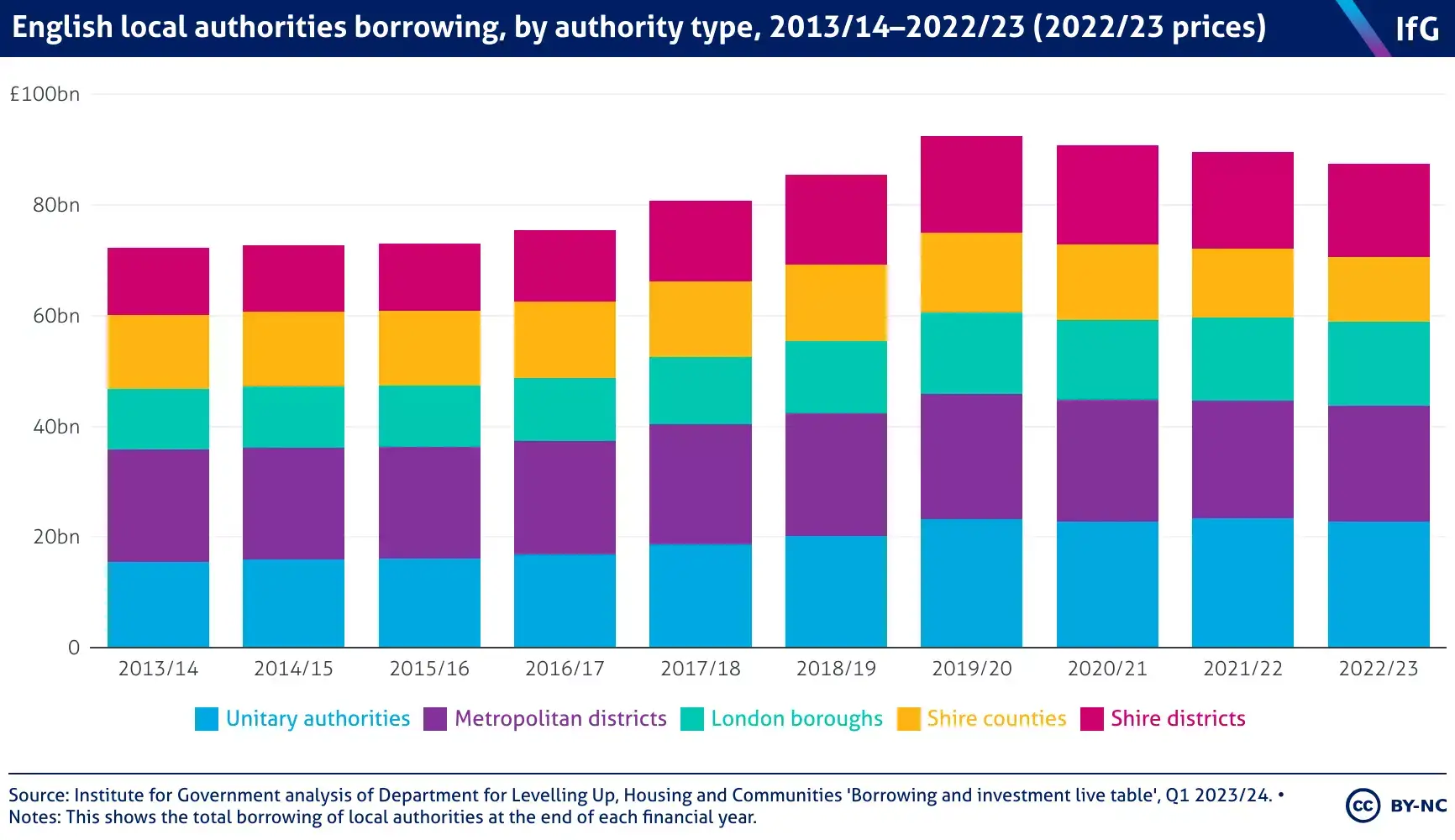

At the heart of the problem lies a profound financial crisis. Local councils in the UK have seen their funding slashed over the past decade, and many are now in severe debt. The UK government has reduced local authority budgets by over 50% since 2010, and the fallout from these cuts is becoming painfully obvious in many areas. According to the National Audit Office (NAO), local authorities in England face a funding gap of £3.9 billion by 2025. With less money coming in, councils have struggled to maintain public services at a time when demand for them has increased.

Case Study: Northamptonshire County Council

One of the most notorious examples of financial mismanagement in recent years is Northamptonshire County Council. In 2018, the council declared itself effectively bankrupt after running up a £70 million deficit. A combination of poor financial planning, overspending on services, and a failure to address the council’s growing debt left it unable to meet its financial obligations. Northamptonshire’s collapse was a wake-up call for local government across the country, highlighting just how fragile some councils’ financial foundations have become. The bankruptcy led to the council being put into special measures and the subsequent reorganization of local government in the county.

Northamptonshire’s woes were compounded by the fact that it was unable to deliver even basic services like social care for the elderly and children’s services. The financial collapse also triggered a significant loss of public trust, as residents saw their local government crumble in the face of mismanagement.

Case Study: Birmingham City Council

Another example of financial mismanagement is Birmingham City Council, the largest local authority in the UK. In 2023, Birmingham announced it was facing a £1 billion budget deficit due to an accumulation of debt from previous years. The council’s financial problems stemmed from a mix of factors, including overspending, poor investment decisions, and a failure to plan for future liabilities. The council was also forced to acknowledge that it had misallocated funds in several key areas, including failed regeneration projects.

Birmingham City Council’s ongoing financial struggles have severely impacted its ability to deliver essential services. Social care, in particular, has been underfunded, with the council unable to meet the needs of its most vulnerable residents. The scale of the financial issues has raised serious concerns about the future of public services in the city, with many wondering how the council will ever get back on track without significant intervention.

Moral Bankruptcy: Failing the Public

While the financial crisis is the most visible issue, many councils are also facing a moral crisis. The ethical shortcomings of some local authorities are just as damaging as their financial mismanagement, leading to further disillusionment among residents and the public at large.

Case Study: Rotherham Borough Council

Rotherham Borough Council is one of the most infamous cases of moral failure in recent years. In 2014, a report from Professor Alexis Jay exposed the systematic sexual abuse of over 1,400 young girls in the town between 1997 and 2013. The report revealed that local authorities, including the police and social services, had failed to protect the victims, and in many cases, had actively covered up the abuse.

The council’s response to the scandal was widely criticized, with many accusing it of prioritizing political correctness over the safety of vulnerable children. The cover-up went on for years, and despite the scale of the abuse, the council did little to address the issue until it was too late. The Rotherham scandal is a clear example of how local government can become morally bankrupt when it loses sight of its duty to protect and serve its citizens, particularly the most vulnerable members of society.

Case Study: Tower Hamlets Borough Council

Another example of moral bankruptcy can be seen in Tower Hamlets, a borough in East London. In 2014, the council was embroiled in a scandal involving the mismanagement of funds meant for local charities. The council was found to have misused public money to fund political campaigns, including funding organizations that were linked to the mayor’s own political interests. This not only breached ethical standards but also undermined public trust in the council’s ability to manage taxpayer money.

The Tower Hamlets case demonstrated the lengths to which some councils are willing to go to consolidate power and influence, even at the cost of their residents’ welfare. The misuse of public funds in such a blatant way is a stark reminder of how moral corruption can pervade local government when checks and balances are weak.

Broken Promises: A Lack of Accountability

Another feature of many councils facing moral and financial bankruptcy is the lack of accountability. Councils often make promises to their residents that they simply cannot keep, whether it’s about the availability of public services, improving local infrastructure, or tackling poverty. When councils fail to meet their obligations, it’s often the most vulnerable in society who bear the brunt of their failings.

In some cases, councils have also been found to have manipulated financial reports to mask their true financial state, misled auditors, or delayed the release of bad news in an attempt to avoid scrutiny. For example, Liverpool City Council was found to have exaggerated its budget estimates and used accounting tricks to delay acknowledging the scale of its financial crisis, potentially putting the future of key services at risk.

A System in Crisis

The moral and financial bankruptcy of UK councils is not just the result of individual mismanagement; it’s a systemic issue. The government’s approach to local government funding has led to a situation where councils are unable to meet the demands placed on them, and local democracy has become increasingly hollow. With councils facing rising costs, dwindling resources, and growing public dissatisfaction, many are struggling to balance their budgets while delivering vital services.

Moreover, the decentralization of services and the reduction of government oversight in recent decades have allowed some councils to operate with little accountability, resulting in poor decision-making and neglect of basic public duties. There is an increasing sense that local government in the UK is no longer capable of meeting its core responsibilities, particularly in the face of growing inequality and social challenges.

The Way Forward: Reforming Local Government

To address this crisis, significant reform is needed. Firstly, councils must be given adequate funding to meet the demands of their populations, with more centralized oversight to ensure that public money is spent effectively. Additionally, a cultural shift in local government is necessary to restore trust in elected officials and civil servants. This could involve stricter regulations around financial transparency, as well as measures to ensure that councils focus on delivering services to those who need them most.

Moreover, councils must also be held accountable for their actions, particularly in cases of gross negligence or mismanagement. Local authorities that fail to serve their residents effectively should face consequences, whether that involves the removal of leaders or the imposition of greater financial scrutiny.

Conclusion

The financial and moral bankruptcy of many UK councils is a reflection of a wider crisis in local government. Councils are struggling under the weight of budget cuts, increasing demand for services, and ethical lapses that have undermined public trust. While some councils have managed to weather the storm, others have fallen into insolvency, leaving their communities to pick up the pieces. If local government in the UK is to be saved, it will require a combination of better financial management, greater transparency, and a renewed commitment to serving the public. Only then can councils begin to rebuild the trust and support that they have lost.